The Agency Relationship in Corporate Finance Occurs

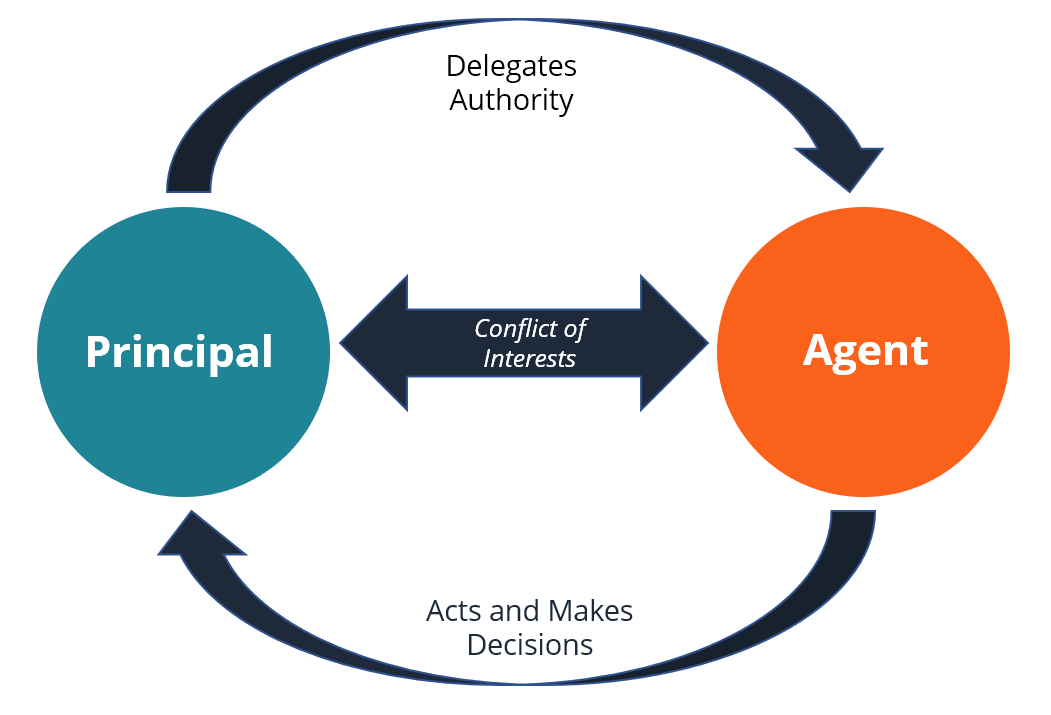

Section II presents the basic. JENSEN Corporate managers are the agents of shareholders a relationship fraught with conflicting interests.

Corporate Finance Unit 4 Financing Decision

Agency theory the anal-ysis of such conflicts is now a major part of the economics literature.

. In the context of finance two of the most important agency relationships are the relationship between stockholders and creditors and. - The authors aim to present corporate finance as the working of a small number of integrated and powerful intuitions rather than a collection of unrelated topics. Arbitrage net present value efficient markets agency theory options and the trade-off between risk and return and use them to explain corporate finance.

Investors want to minimize expected return for a. The next section of the paper describes our data and presents a number of examples of ownership patterns in particular companies. Investors want to maximize expected return for a given level of risk so capital flows to its most efficient use.

Agency relationships occur when one or more individuals the principals hire another individual the agent to perform a service on behalf of the principals12 In an agency relationship principals often delegate decision-making authority to the agent. The results suggest that the theory of corporate finance relevant for most countries should focus on the incentives and opportunities of controlling shareholders to both benefit and expropriate the minority shareholders. Agency Costs of Free Cash Flow Corporate Finance and Takeovers By MICHAEL C.

Should a firm obtain funding through equity that is from shareholders expecting dividends or through debt that is from bondholders who lend money to the firm and have a contractual right to receive interest on the loans or through a combination of the two. One question concerns a firms capital structure. - They develop the central concepts of modern finance.

The payout of cash to shareholders creates major conflicts that have received little. How does the relationship between risk and expected return serve to allocate capital in a market. Corporate finance concerns the financing of firms.

Investors want to minimize expected return and maximize their exposure so capital flows to its least efficient use.

Principal Agent Problem Overview Examples And Solutions

Pdf A Contemporary View Of Corporate Finance Theory Empirical Evidence And Practice

Pdf Agency Theory Review Of Theory And Evidence On Problems And Perspectives

No comments for "The Agency Relationship in Corporate Finance Occurs"

Post a Comment